Goods and Service Tax (GST) Registration for Foreigners

Even you an foreign entity doing business and involved in buying / selling or providing of services in India, you are obligatory to get the GST registration for your business.

Digital Filings can help you in…:

![]() Drafting GST registration application

Drafting GST registration application

![]() Furnishing and Arranging the required documents

Furnishing and Arranging the required documents

![]() Filing application under GST

Filing application under GST

![]() Obtaining the GST Identification Number (GSTIN)

Obtaining the GST Identification Number (GSTIN)

Get Started!

Understanding the GST for Foreigner Tax Payers

GST was implemented in India effective July, 1st 2017. Along with Indian business owners, non-resident taxpayers are also required to obtain GST registration and file GST returns for performing any business transaction in India. According to the GST Act, “non-resident taxable person” means any person who occasionally carry out any business transaction, including supply of goods or services or both, whether as principal or agent or in any other capacity, but who has no fixed place of business or residence in India. All non-resident taxable persons are required to appoint an authorized person in India for the purpose of complying with GST regulations.

Further, non-resident taxpayers are required to obtain GST registration as a Non-Resident Foreign Taxpayer 5 days prior to the executing any business deal in India. An application for GST registration for foreign non-resident taxable person must be drafted and filed by an authorized agent in India. Post submitting an application for GST registration, a transaction number will be generated and GST must be deposited, under the issued transaction number, by taxpayer to obtain GST registration in India.

Key-Advantages of GST System

Standardized Taxes

Numerous conventional tax systems, including Central Sales Tax, Additional Customs Duty, Purchase Tax, and others are strategically subsumed under single standardized tax mechanism, named GST. The recent tax scheme has further simplified the overall tax collection process and drastically eased-off the cumbersome tax compliance for nation-wide businesses.

Relieved Businesses

Before GST, ventures like restaurants, computer sales & services, among others had to bear various compliance burdens of calculating transaction based taxes (including VAT and Service Tax) for varied items at respective tax rates. Under GST, the distinction between goods and services has been eliminated to further un-complex the complex tax system for businesses.

Vast Tax Base

GST has significantly increased the tax base in India, therefore reducing the overall tax liability of businesses, as a large chunk of businesses is getting complied with GST regulations. Moreover, GST will be linked with people’s databases, including AADHAAR, PAN, and others, thus making GST registration and GST return filing process, a more seamless process.

Streamlined Tax Mechanism

GST was implemented in India to streamline and standardize the Nation’s indirect taxes mechanism. GST enabled business owners to have only one GST registration that will be valid across India for selling or purchasing goods or offering services. Moreover GST has relieved businesses from the complexities of obtaining multiple VAT registrations in different States and maintaining separate VAT and Service Tax registration.

Required Documentation Chart

For Foreign Nationals

- Notarized or Apostilled copy Passport for Foreign Nationals and NRIs,

- Scanned copy of Voter’s ID/Passport/Driver’s License

- Scanned passport-sized photograph

- Specimen signature (blank document with signature [for Foreign Nationals / NRIs,only])

Best Service Solutions by Digital Filings

Proficient Partners@Digital Filings have strategically devised an End-to-End GST compliance support process, starting from GST registration to GST return filing, to assist Foreign Companies / NRIs.

Schedule your FREE yet Extensive Consultation on GST registration, GST accounting, and GST return filing with Qualified Advisers@Digital Filings… TODAY!

Pocket-Friendly Options

Basic

Package Include:

GST registration for Taxable Foreign Nationals / NRIs (Above price includes all taxes and relevant government fees.)

GST registration for Taxable Foreign Nationals / NRIs (Above price includes all taxes and relevant government fees.)

Standard

Package Include:

GST registration for Taxable Foreign Nationals / NRIs

GST registration for Taxable Foreign Nationals / NRIs  Authorised Signatory appointment (Above price includes all taxes and relevant government fees.)

Authorised Signatory appointment (Above price includes all taxes and relevant government fees.)

Premium

Package Include:

GST registration for Taxable Foreign Nationals / NRIs

GST registration for Taxable Foreign Nationals / NRIs Authorised Signatory appointment

Authorised Signatory appointment 12-Month GSTR-5 Filing

12-Month GSTR-5 Filing- (Above price includes all taxes and relevant government fees.)

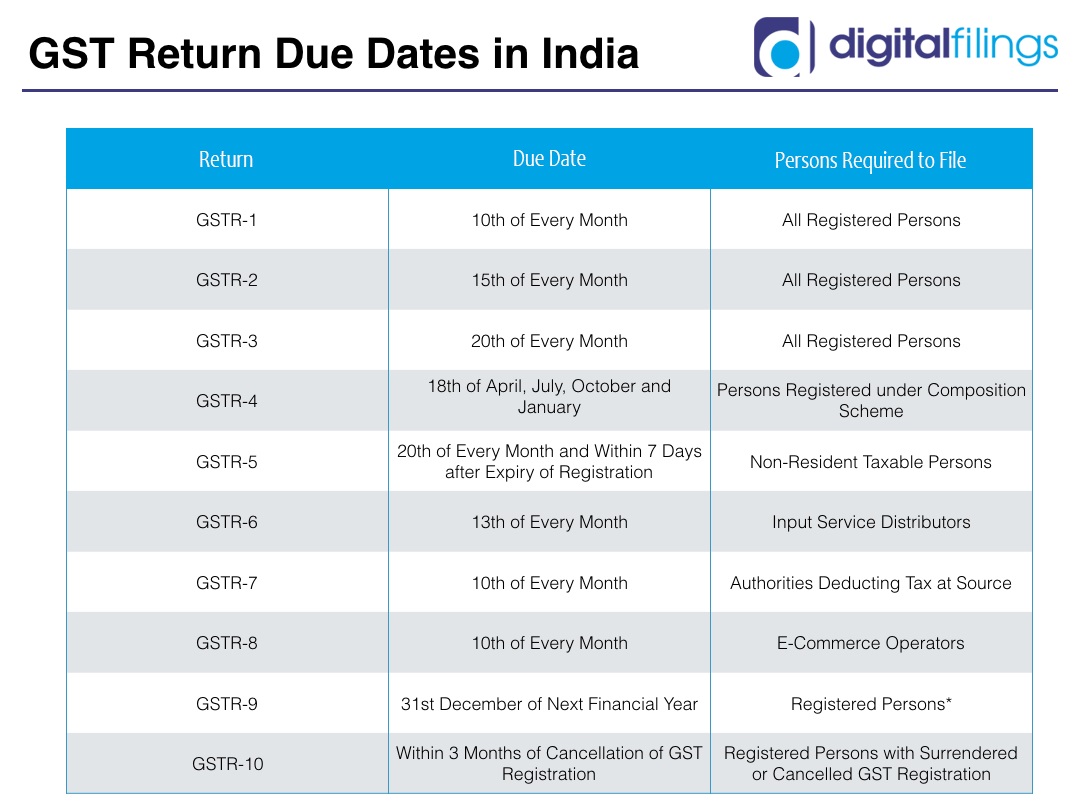

Tap the Image for a Close-Shot!

GST Return (GSTR) Filing Schedule:

Tap Here for More:

| GSTR 1 Return: | GSTR1 or return of outward supplies must be filed by all taxpayers having regular GST registration. The due date for filing GSTR1 return is the 10th of every month. For July, September and October, the GST return due dates are different from the normal schedule. |

| GSTR 2 Return: | GSTR2 or return of inward supplies must be filed by all taxpayers having regular GST registration. The due date for filing GSTR 2 return is the 15th of every month. For July, September and October, GSTR2 return due dates are different from the normal schedule. |

| GSTR 3 Return: | GSTR3 or monthly GST return must be filed by a taxpayer after filing GSTR1 and GSTR2 return. GSTR3 is due on the 20th of every month. For July, September and October, GSTR2 return due dates are different from the normal schedule. |

| GSTR 4 Return: | GSTR4 return must be filed by taxpayer registered under the GST composition scheme. GSTR4 is a quarterly return that is due on the 18th of October, January, April and July. |

| GSTR 5 Return: | GSTR5 return must be filed by persons registered under GST as a non resident taxable person. GSTR5 is due on the 20th of every month. |

| GSTR 6 Return: | GSTR6 return must be filed by persons registered under GST as an input service distributor. GSTR6 return is due on the 13th of every month. |

| GSTR 7 Return: | GSTR7 return must be filed by all taxpayers required to deduct tax at source (GST TDS). Under GST, only certain government agencies are required to deduct tax at source after obtaining registration. Hence, GSTR7 is due only for those entities having GST TDS registration. GSTR7 is due on the 10th of every month. |

| GSTR 8 Return: | GSTR8 return must be filed by taxpayers required to collect tax at source. E-commerce operators are required to collect tax at source. Hence, any persons operating an e-commerce venture must register for TCS, collect tax at source and file GSTR8 return before the 10th of every month. |

| GSTR 9 Return: | GSTR9 is GST annual return that must be filed by all regular taxpayers. Details submitted with GSTR9 must be audited if the entity has a turnover of more than INR 2 crores. GSTR9 is due on or before the 31st of December. |

| GSTR 10 Return: | GSTR10 return must be filed by any person whose GST registration has been cancelled or surrendered. GSTR10 must be filed within 3 months of the date of cancellation order or surrender. |

| GSTR 11 Return: | GSTR11 must be filed by persons having Unique Identity Number. GST Unique Identity Number is allotted to Consulate, Embassies and UN Bodies for claiming refund on inward supplies. |

Click Here for More:

| GSTR 1 Return: | GSTR1 or return of outward supplies must be filed by all taxpayers having regular GST registration. The due date for filing GSTR1 return is the 10th of every month. For July, September and October, the GST return due dates are different from the normal schedule. |

| GSTR 2 Return: | GSTR2 or return of inward supplies must be filed by all taxpayers having regular GST registration. The due date for filing GSTR 2 return is the 15th of every month. For July, September and October, GSTR2 return due dates are different from the normal schedule. |

| GSTR 3 Return: | GSTR3 or monthly GST return must be filed by a taxpayer after filing GSTR1 and GSTR2 return. GSTR3 is due on the 20th of every month. For July, September and October, GSTR2 return due dates are different from the normal schedule. |

| GSTR 4 Return: | GSTR4 return must be filed by taxpayer registered under the GST composition scheme. GSTR4 is a quarterly return that is due on the 18th of October, January, April and July. |

| GSTR 5 Return: | GSTR5 return must be filed by persons registered under GST as a non resident taxable person. GSTR5 is due on the 20th of every month. |

| GSTR 6 Return: | GSTR6 return must be filed by persons registered under GST as an input service distributor. GSTR6 return is due on the 13th of every month. |

| GSTR 7 Return: | GSTR7 return must be filed by all taxpayers required to deduct tax at source (GST TDS). Under GST, only certain government agencies are required to deduct tax at source after obtaining registration. Hence, GSTR7 is due only for those entities having GST TDS registration. GSTR7 is due on the 10th of every month. |

| GSTR 8 Return: | GSTR8 return must be filed by taxpayers required to collect tax at source. E-commerce operators are required to collect tax at source. Hence, any persons operating an e-commerce venture must register for TCS, collect tax at source and file GSTR8 return before the 10th of every month. |

| GSTR 9 Return: | GSTR9 is GST annual return that must be filed by all regular taxpayers. Details submitted with GSTR9 must be audited if the entity has a turnover of more than INR 2 crores. GSTR9 is due on or before the 31st of December. |

| GSTR 10 Return: | GSTR10 return must be filed by any person whose GST registration has been cancelled or surrendered. GSTR10 must be filed within 3 months of the date of cancellation order or surrender. |

| GSTR 11 Return: | GSTR11 must be filed by persons having Unique Identity Number. GST Unique Identity Number is allotted to Consulate, Embassies and UN Bodies for claiming refund on inward supplies. |

Click the Image for a Close-Shot!

How we Do It…

Experts@Digital Filings can effectively assist you getting your GST registration done, in about 10 – 15 working days, subject to processing time of government authorities and document submission by clients.

Get GST Application Prepared

Our GST Expert will collect all the requisite documents required for applying for GST Registration along with signature in a prescribed format through our advanced platform.

Application Submission

On the successful collection of necessary documents and preparation of the application, we will request for registration on GST Portal and also share your Application Reference Number (ARN) number.

Here is your GST and GSTIN Certificate

The GST officer verifies the application and discloses information of foreign individual / NRIs. On successful verification, your GSTIN and GST certificate will be provided to you.

Our Patrons’ Speak

Mission Statement

Every Partner at Digital Filings is Focused...

...to Provide a Comprehensive Legal Assistance Mechanism...

...Diligently Customized for Emerging Entrepreneurs!

We at a Glance...

Digital Filings is a leading business and legal services provider in India, assisting entrepreneurs in effectively and economically setting-up and managing their venture. Digital Filings consistently ensures that your venture is always compliant, so you can efficiently focus on making your business ascend.

Our strong network of proficient partners thoroughly understands the business specific regulatory/legal requirements and is focused to assist business owners at every stage of their venture.

Our panel of competent professionals, including Chartered Accountants, Company Secretaries, Lawyers, Cost Accountants, Chartered Engineers, Financial Gurus, and Business Experts are just a call away to gladly serve you.

Book your appointment Today!

Media Talks

Knowledge Arena

Be our guest to browse the Knowledge Arena by Digital Filings and widen your knowledge-base.

Digital Filings always strive to enhance the understanding of our patrons on the Nation's consistently modifying compliance environment. Our well-informed team of partners has diligently compiled numerous articles, guides, videos, and much more that you can browse anytime at your ease.

Why DigitalFilings

Easy Registration

Experts at Digital Filings can proficiently help in registering your sole proprietorship firm, either by getting you a GST / VAT Number, Service / Professional Tax Registration, a Shops & Establishments Act Registration, a Micro, Small & Medium Enterprises (MSME) Registration, or an Import-Export Code.

Supportive Team

The team of well-informed professionals at Digital Filings is just a phone call away to address every concern / query about the registration of your sole proprietorship venture. We will, however, put our best to make sure that all your questions are well-answered even before they strike in your mind.

Expert Support

Experts at Digital Filings precisely understand all of your requirements and strive to ensure that all the desired documents are in place so that you can effectively align yourself with every legal / administrative interaction. We will also provide you complete clarity on the process to set genuine expectations.

“Heartfelt thank you for proficiently taking care of all the registration related tasks and letting me focus on my business operation without any stress.”

“Heartfelt thank you for proficiently taking care of all the registration related tasks and letting me focus on my business operation without any stress.”