Limited Liability Partnership (LLP)

LLP model has over the last decade proved to be a simplest way of establishing a business entity providing limited liability to its owners. LLPs are appropriate for professional services firms, such as financial advisories, ad-agencies, and others.

Digital Filings can help you in…:

![]() Obtaining Digital Signature Certificates (DSCs) and Designated Partner Identification Number (DPIN) (Two Each);

Obtaining Digital Signature Certificates (DSCs) and Designated Partner Identification Number (DPIN) (Two Each);

![]() Registering the Director with the Ministry of Corporate Affairs (MCA);

Registering the Director with the Ministry of Corporate Affairs (MCA);

![]() Assisting you Picking up a Unique Name for your LLP;

Assisting you Picking up a Unique Name for your LLP;

![]() Drafting constitution / LLP Agreement for the business;

Drafting constitution / LLP Agreement for the business;

![]() Getting the Company’s TAN and PAN Issued by the NSDL.

Getting the Company’s TAN and PAN Issued by the NSDL.

Get Started!

Understanding the LLP Model

LLP was introduced in India through the Limited Liability Partnership Act 2008 for a primary reason of providing an easy to manage business-model with the included benefits of a limited liability framework to all the partners, thus protecting them within the partnership as well as outside of it, similar to that of shareholders in a Private Limited Company (PLC).

In an LLP model, one partner is not responsible for any neglect or wrong-doing committed by another partner. Unlike in a traditional partnership firm, the partnership collectively is liable for any debt of the LLP and not the partners in their individual capacity.

An easy incorporation process and modest compliance requirements make LLP a favorite option among budding professionals as well as small businesses that were traditionally family-owned enterprises. LLPs are fairly easy to manage and operate, and the 29,400 LLPs registered in India solely in FY 2016-17 are proof enough for the same.

An LLP cannot issue equity shares to raise venture capital. It is, therefore, an ideal framework for enterprises that do not wish to go down that road during its lifespan, and so are relieved from excessive paperwork and compliance.

Key-Advantages of an LLP

Distinct Entity

An LLP is a separate legal entity and, therefore, can own property, incur debts, can sue / be sued, and enjoys various other benefits in its legal capacity. Assets owned by an LLP are solely under its ownership, and no partner can claim those. Additionally, the partners of an LLP are not personally liable to the creditors for the debts entered into by the LLP.

Perpetual Succession

Until an LLP is legally dissolved, it can enjoy the privileges of an on-going business concern, irrespective of the demise or exit of any partner.

Limited Liability

The partners’ liability in an LLP is limited to the extent of their individual contribution to the business. Moreover, partners’ personal assets are protected from any liability of the LLP, unless any fraud is detected.

Agreement Flexibility

Every Partner in an LLP enjoys a freedom to draft the LLP agreement (to define the roles, authorities, and responsibilities) as per their own preferences.

Fewer Mandates

Unlike a PLC, an LLP is much easier and cheaper to operate as there are less annual compliances, making it an appropriate mechanism for start-ups and small businesses that seek minimal compliance and regulatory mandates. Moreover, there is no audit required, if an LLP has less than INR 40 Lacs of turnover and a capital contribution of below INR 25 Lacs.

No Distinction

An LLP has partners as its owners and managers, unlike a PLC business model, where directors may be different from its shareholders.

Easy to Shut-Down

As compared to the PLC, an LLP is easy to set-up and simpler to wind-up. While it still takes just 2 to 3 months to complete the winding-up process, it can take over a year to shut-down an operational PLC.

Easy to Transfer

Since LLP holds a separate identity from that of its partners, the ownership can easily be transferred, just by introducing other partners in the LLP.

Required Documentation Chart

Indian Resident

- Self Attested and Scanned copy of PAN Card or Passport

- Self Attested and Scanned copy of Voter’s ID / Passport / Driver’s License

- Self Attested and Scanned copy of Latest Bank Statement / Telephone or Mobile Bill / Utility Bills (Electricity / Water / Gas)

- Scanned passport-sized photograph

- Specimen signature (blank document with signature)

For the Registered Office

- Scanned copy of Latest Bank Statement / Telephone or Mobile Bill / Utility Bills (Electricity / Water / Gas)

- Scanned copy of Notarized Rental Agreement in English

- Scanned copy of No-Objection Certificate from the property owner

- Scanned copy of Sale Deed/Property Deed in English (in case of owned property)

Note: Registered office can be a commercial space or even a residence.

Non-Resident Indian / Foreign Resident

- Notarized and Scanned copy of Passport*

- Notarized and Scanned copy of Passport / Driver’s License*

- Notarized and Scanned copy of Latest Bank Statement / Telephone or Mobile Bill / Utility Bills (Electricity / Water / Gas)*

- Specimen signature (blank document with signature)

*Documents to be apostilled if the director is from a Commonwealth country.

For the Registered Office

- Scanned copy of Latest Bank Statement / Telephone or Mobile Bill / Utility Bills (Electricity / Water / Gas)

- Scanned copy of Notarized Rental Agreement in English

- Scanned copy of No-Objection Certificate from the property owner

- Scanned copy of Sale Deed/Property Deed in English (in case of owned property)

Note: Registered office can be a commercial space or even a residence.

Digital Filings Service Package Includes:

• DSCs and DINs for all the Partners

• Drafting of MoA and AoA

• Registration fees and stamp duty

• Company Incorporation Certificate

What People Frequently Ask…

How many minimum partners required to form an LLP?

What is the minimum capital requirement for setting-up an LLP?

There is no minimum capital requirement in case of an LLP, however, it should have an authorized capital of at least INR 1 lac.

Does the LLP registration can only be done on a commercial property?

Who can be a designated partner or a partner in an LLP?

Can a Nor-Resident Indian (NRI) set-up an LLP business in India?

What are the general rules of starting an LLP?

What kind of start-ups commonly register for the LLP mode?

Is operating an LLP is economical than to run a private limited company (PLC)?

Pocket-Friendly Options

Basic

Package Include:

LLP Registration with DSC and DIN

LLP Registration with DSC and DIN LLP Deed Drafting and Name Approval

LLP Deed Drafting and Name Approval Obtaining PAN and TAN

Obtaining PAN and TAN Government Fees for Incorporation

Government Fees for Incorporation- (Above price includes all taxes and relevant government fees.)

Standard

Package Include:

LLP Registration with DSC and DIN

LLP Registration with DSC and DIN  LLP Deed Drafting and Name Approval

LLP Deed Drafting and Name Approval  Obtaining PAN and TAN

Obtaining PAN and TAN  Government Fees for Incorporation

Government Fees for Incorporation  12 Months TDS Returns Filing (Above price includes all taxes and relevant government fees.)

12 Months TDS Returns Filing (Above price includes all taxes and relevant government fees.)

Premium

Package Include:

LLP Registration with DSC and DIN

LLP Registration with DSC and DIN  LLP Deed Drafting and Name Approval

LLP Deed Drafting and Name Approval  Obtaining PAN and TAN

Obtaining PAN and TAN  Government Fees for Incorporation

Government Fees for Incorporation  12 Months TDS Returns Filing and Trademark Filing (Above price includes all taxes and relevant government fees.)

12 Months TDS Returns Filing and Trademark Filing (Above price includes all taxes and relevant government fees.)

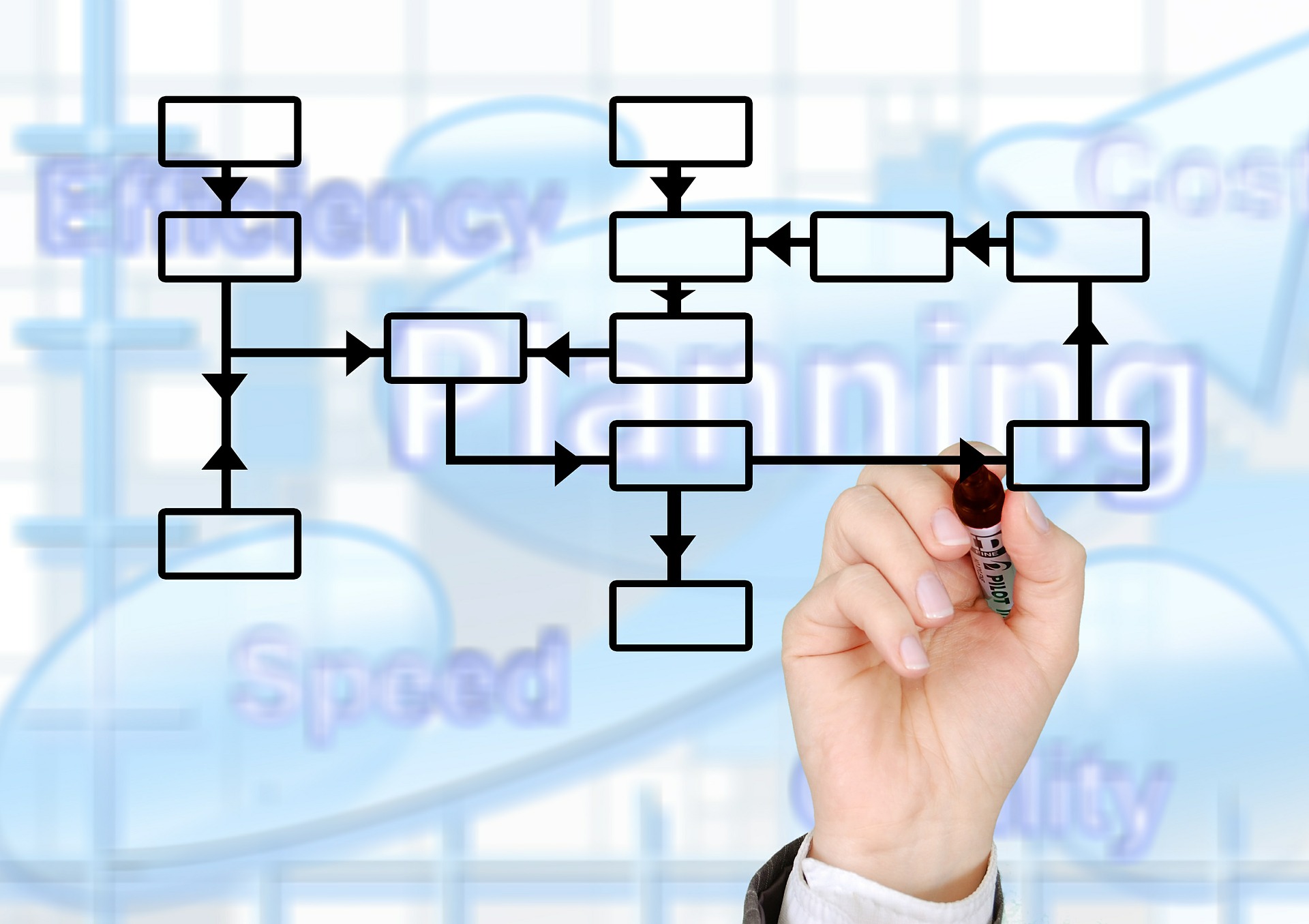

How we Do It…

LLP Registration Process is fairly simple can be completed in just 15-20 business days. Experts Digital Filings will assist you with the requirements and everything you need to know about Registration Process.

First Arrange them All

The foremost action item to register an LLP is to obtain DSC and DPIN for all the proposed partners. Digital Filings can help you getting these documents within 5-7 working days. DSC is required since all the forms need to be submitted online with digital signatures of the proposed partners. Application for DPIN, however, has to be made in Form DIR-3.

Name it Distinctively

Before to start with registering a unique name for the LLP, you need to make sure if the desired name is still available. Name availability can be checked using the free search facility on the MCA portal. Once found and finalized, following the defined naming guidelines, the business name can be approved and registered in 5-7 working days, depending on the MCA’s processing time. Also, an LLP can submit at-least one and a maximum of six name choices to the MCA.

Put it all on Paper

Drafting an agreement is critical while registering an LLP. Essentially, an LLP agreement includes the mutual rights, roles, and responsibilities among the partners as well as between the LLP and the partners. For the LLP Agreement, the partners need to file an online Form-3 on the MCA portal within 30 days of the date of incorporation.

Final Formalities

Once the registrar approves the MoA and AoA, the next step is to get the LLP Incorporation Certificate to call your LLP a registered entity. Digital Filings can assist you in submitting all the required incorporation documents along with an application for incorporation to the MCA within 2-12 business days, while authorities at MCA usually approve the incorporation application in 10-12 working days, subject to the processing time.

Apply and Obtain the Rest

On receiving the incorporation certificate for the LLP, Digital Filings will help you in applying for PAN and TAN with the NSDL that takes around three weeks to get those issued.

Our Patrons’ Speak

Mission Statement

Every Partner at Digital Filings is Focused...

...to Provide a Comprehensive Legal Assistance Mechanism...

...Diligently Customized for Emerging Entrepreneurs!

We at a Glance...

Digital Filings is a leading business and legal services provider in India, assisting entrepreneurs in effectively and economically setting-up and managing their venture. Digital Filings consistently ensures that your venture is always compliant, so you can efficiently focus on making your business ascend.

Our strong network of proficient partners thoroughly understands the business specific regulatory/legal requirements and is focused to assist business owners at every stage of their venture.

Our panel of competent professionals, including Chartered Accountants, Company Secretaries, Lawyers, Cost Accountants, Chartered Engineers, Financial Gurus, and Business Experts are just a call away to gladly serve you.

Book your appointment Today!

Media Talks

Knowledge Arena

Be our guest to browse the Knowledge Arena by Digital Filings and widen your knowledge-base.

Digital Filings always strive to enhance the understanding of our patrons on the Nation's consistently modifying compliance environment. Our well-informed team of partners has diligently compiled numerous articles, guides, videos, and much more that you can browse anytime at your ease.

Why DigitalFilings

Easy Registration

Experts at Digital Filings can proficiently help in registering your sole proprietorship firm, either by getting you a GST / VAT Number, Service / Professional Tax Registration, a Shops & Establishments Act Registration, a Micro, Small & Medium Enterprises (MSME) Registration, or an Import-Export Code.

Supportive Team

The team of well-informed professionals at Digital Filings is just a phone call away to address every concern / query about the registration of your sole proprietorship venture. We will, however, put our best to make sure that all your questions are well-answered even before they strike in your mind.

Expert Support

Experts at Digital Filings precisely understand all of your requirements and strive to ensure that all the desired documents are in place so that you can effectively align yourself with every legal / administrative interaction. We will also provide you complete clarity on the process to set genuine expectations.

“Heartfelt thank you for proficiently taking care of all the registration related tasks and letting me focus on my business operation without any stress.”

“Heartfelt thank you for proficiently taking care of all the registration related tasks and letting me focus on my business operation without any stress.”