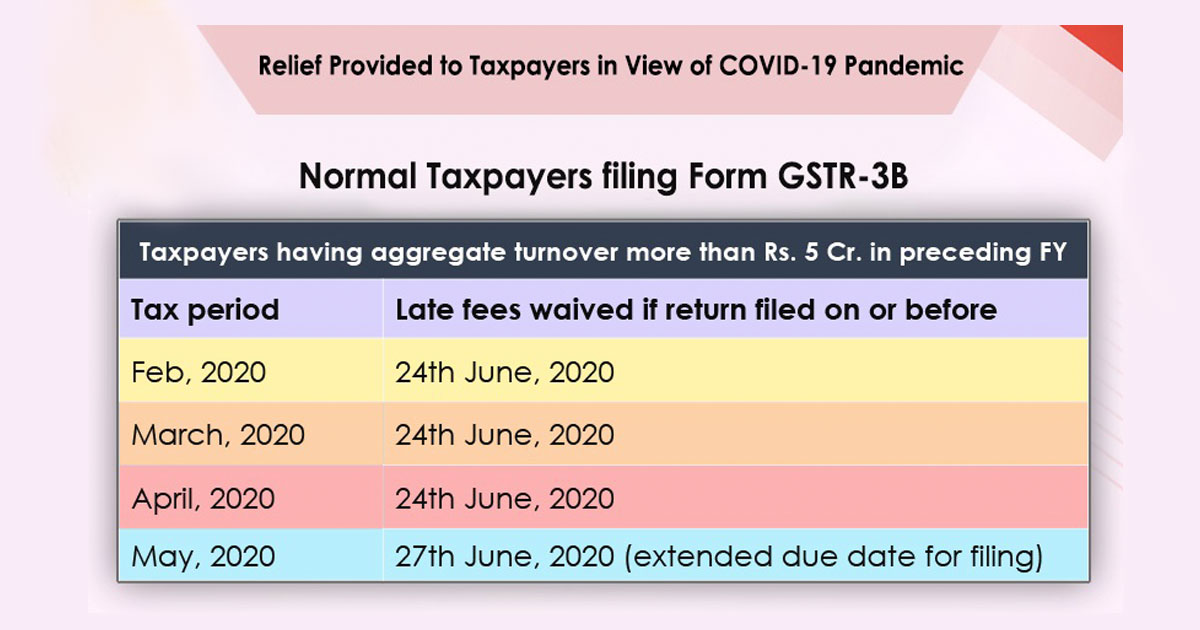

Due to COVID-19 pandemic and challenges faced by taxpayers, Government has extended dates for GST filings.

Normal Taxpayers filing Form GSTR-3B

a.Taxpayers having aggregate turnover > Rs. 5 Cr. in preceding FY

| Tax period | Late fees waived if return filed on or before |

|---|---|

b.Taxpayers having aggregate turnover of > Rs. 1.5 crores and upto Rs. 5 crores in preceding FY

| Tax period | Late fees waived if return filed on or before |

|---|---|

c.Taxpayers having aggregate turnover of upto Rs. 1.5 crores in preceding FY

| Return/Tax period | Late fees waived if return filed on or before |

|---|---|

d.Taxpayers having aggregate turnover of upto Rs. 5 Cr. in preceding FY

| Tax period | Extended date and no late fees if return filed on or before | Principal place of business is in State/UT of |

|---|---|---|

Other Latest News

December 31, 2020 / GST News

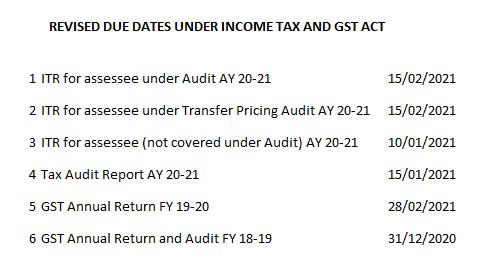

Government extended the deadline to file ITR for individuals & businesses, Check New Dates

Government extended the deadline to file ITR for individuals & businesses, Check New Dates on this page.

Read More

December 23, 2020 / GST News

CBIC waives fee payable on late filing of GSTR-4 for businesses in Ladakh until 31st December 2020

CBIC waives fee payable on late filing of GSTR-4 for businesses in Ladakh until 31st December 2020

Read More

December 23, 2020 / ITR News

CBDT has notified that the total ITR filed till 21st December 2020 is 3.75 crores

The Central Board of Direct Taxes has notified that the total Income Tax Returns filed till 21st December 2020 for AY 2020-21, is 3.75 crores. Read the ITR-Wise break-up of the figure below:

Read More

May 25, 2020 / GST News

Governor Shaktikanta Das Press Conference Highlights

Reserve Bank of India’s present governor Shaktikanta Das called for a press conference on May 22 to announce some major steps to revive the falling economy.

Read More

May 18, 2020 / GST News

Government to Clear Pending Refunds for IT Department

The authorities will immediately release the refund for up to Rs 5 Lakh, and some 14 Lakh taxpayers will get the benefit after the release of pending refunds.

Read More

May 16, 2020 / GST News

Quick Review of the Economic Package of 20 Lakh Crore

Is PM’s Economic Package beneficial for ‘Tax Payers’? Quick Review of the New Stimulus Economic Package of 20 Lakh Crore.

Read More

May 16, 2020 / GST News

Extended date of the Income Tax Return (ITR) 2020

The date for Income Tax Return Filing has been extended to November 30, 2020, The finance minister said.

Read More

April 13, 2020 / GST News

GST Rate on PPE KIT Face Mask and Sanitizers

Current GST Rate on PPE KIT Face Mask, Sanitizers and other medical equipments.

Read More

April 10, 2020 / GST News

GST Filing Important dates 2020

GST Filing Important dates 2020.

Read More

April 10, 2020 / GST News

GST Filing Dates extended for providing relief to Taxpayers

Due to COVID-19 pandemic and challenges faced by taxpayers, Government has extended dates for GST filings.

Read More