by user | Feb 1, 2021 | GST Latest News

Exemption duty on steel scrap up to March 2022; customs duty on naphtha cut to 2.5 pc: FM Rationalising customs duties on gold and silver says FM in Budget for 2021-22 Customs duty on cotton increased to 10%, silk to 15% Customs duty on solar lanterns cut to 5% FM...

by user | Dec 31, 2020 | GST Latest News

CBDT issues press release for extension of due dates for filing Income-Tax Returns and Tax Audit Reports under the Income-tax Act, 1961 for AY 2020-21 Government of IndiaMinistry of FinanceDepartment of RevenueNew Delhi 30.” December, 2020 PRESS RELEASE...

by user | Dec 19, 2020 | Uncategorized

Date: 16/12/2020 Smt. Nirmala Sitharaman.Honorable Minister of Finance,Government of IndiaNew Delhi-110001 Madam, Subject: Request for extension of Due date for filing Income Tax Return of AY 2019-20 & AY 2020-21 and for filing of Audit Report under various...

by user | Dec 19, 2020 | Uncategorized

Government of IndiaDepartment of RevenueMinistry of Finance Central Board of Direct TaxesNew Delhi, 16th December, 2020 Income Tax Department conducts searches in Chandigarh The Income Tax Department carried out search and seizure operations on 13.12.2020 in the case...

by user | Dec 17, 2020 | Uncategorized

15th December 2020ToSmt. Nirmala Sitharaman,The Hon’ble Finance Minister,Ministry of Finance,Government of India,North Block,New Delhi–110 001. Respected Madam, Re: Request for extension of various due dates under Income-tax Act, 1961 for AY 2020-21 and for filing the...

by user | Oct 3, 2020 | Uncategorized

Relief in late fees to Taxpayers filing Form GSTR-4 or 10 1) Relief to Composition Taxpayers in late fees for delayed filing of Form GSTR-4 (Quarterly Return): a) Vide Notification No 67/2020 dated 21.09.2020, the taxpayers who were under Composition Scheme, during...

by user | May 4, 2020 | Uncategorized

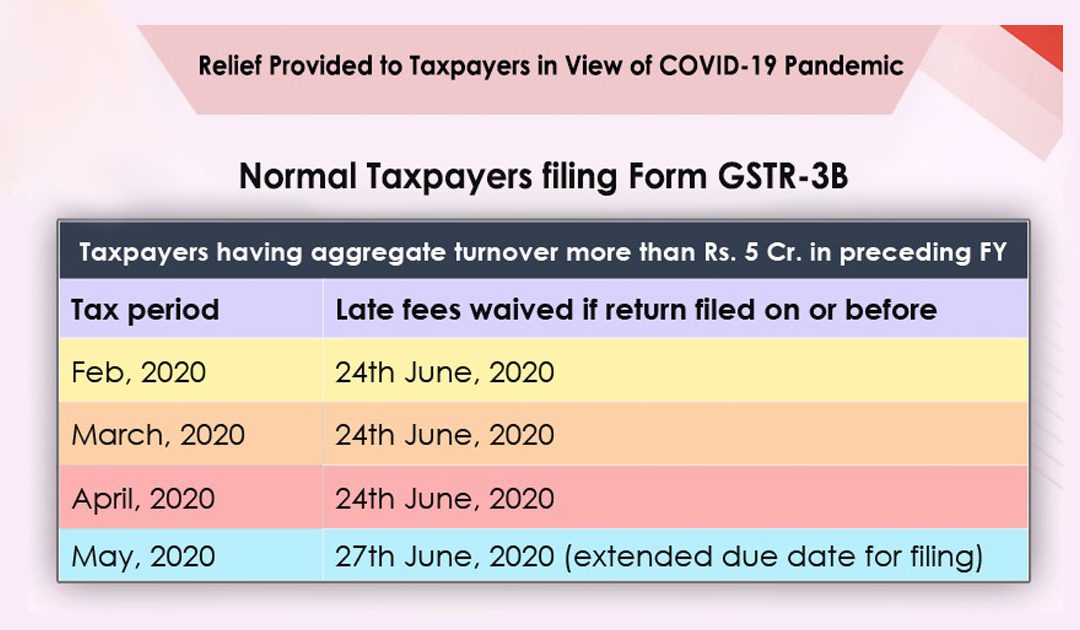

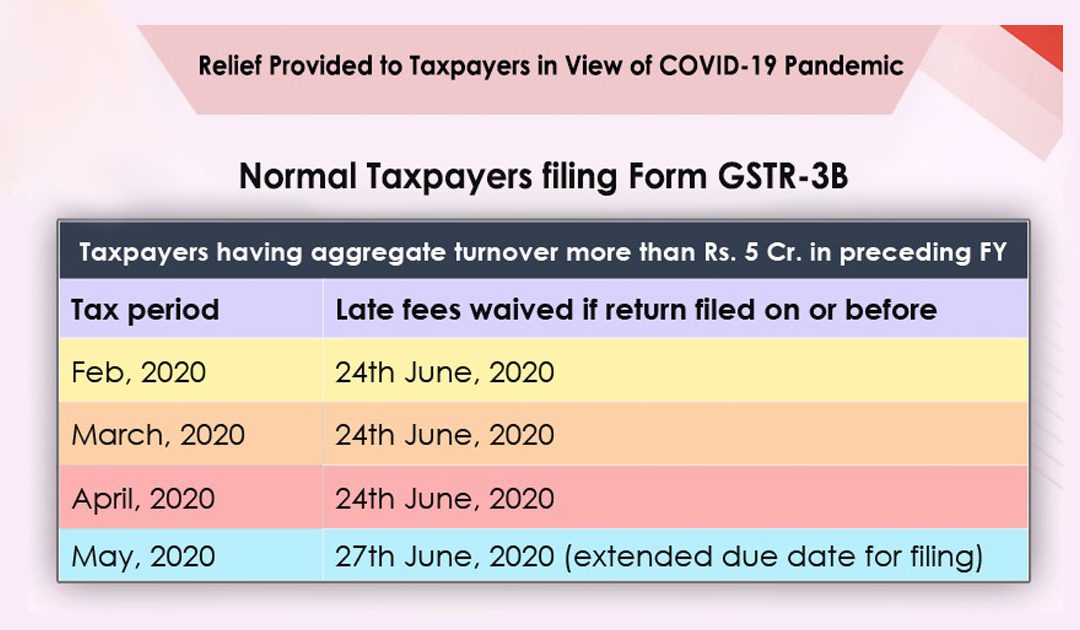

Extended Date of GST Return FileThere is no doubt the pandemic covid-19 has severally impacted all sectors including the businesses. It has not just resulted in the demise of major population on a global level, but has impacted the economy of developed and developing...

by user | May 4, 2020 | Uncategorized

COVID-19 Relief Provided by Indian Government for GST and ITR On March 24, 2020, the Government of India took the required measures in areas such as ITR (Income Tax Return), GST (Goods and Services Tax), Custom and Central Excise, and so on. The Union Finance and...

by user | May 2, 2020 | Uncategorized

Current GST Rates for Medical Equipment (Mask, Sanitizer, PPE Kit) The demand for medical equipment such as Diagnostic Test Kits, Surgical Masks, Blood Test Strips, Sanitizers, etc. has increased after the outbreak of COVID-19 Pandemic. It is essential to have an idea...